|

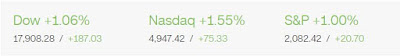

| Dow, NASDAQ, and S&P by closing time (5:16pm ET) |

|

| Dow and NASDAQ throughout trading hours (5:16pm ET) |

- Dow closed with 18041.55 points, which was 0.28% higher and 51.23 points more than yesterday's closing time.

- Nasdaq closed with 4863.14 points, which was 0.51% lower and 25.14 points less than yesterday.

- S&P500 closed with 2095.15 points, which was 0.16% higher and 3.45 points higher than yesterday.

- WTI Crude Oil prices have achieved an new 2016 high, soaring above $45 per barrel.

- $45.28 per barrel (6:16pm ET)

International/U.S. market

- Unlike the other two indexes, NASDAQ suffered alone today as Apple (AAPL) and Twitter (TWTR) stocks plunged as they released their quarter reports today.

- Federal Reserve has announced that they are fixing their key interest rate from 0.25~5%, mainly because U.S. and world economy wasn't doing that well.

- Oil prices soared around 3% today, going over $45 per barrel and achieving a new 2016 high.

- U.S. Dollar went bearish as Federal Reserve announced that they will freeze the key interest rate. The Dollar Index reached 94.39, which was 0.12% lower than yesterday.

- European Market continued to rise from yesterday, and it was mainly the energy industry that made the market bullish. British FTSE100 rose 0.56% higher, French CAC40 rose 0.58%, and German DAX rose 0.39%.

Company Analysis

- Apple (AAPL) stocks plunged today as they revealed their quarter report, which showed that their revenue has dropped for the first time in 13 years. One of the major reasons of this was the failure of iPhone 6S, which sold 10 million fewer than last quarter. Apple stocks fell 6.27% today.

- Twitter (TWTR) stocks also plunged today as they posted their quarter reports, which showed that Revenue Growth was lagging. Twitter stocks fell 16.28% today.